Table of Content

- FREED Financial Services LLC

- Everything About Balloon Payment and How it is Calculated

- Is Home Loan Restructuring a Smart Idea?

- Tips to restructure mortgage loan

- How Do I Get Government Help to Pay for My House?

- At the moment my income has not been impacted, but it may happen in the future. Can I apply for loan restructuring?

- What is meant by the restructuring of loans?

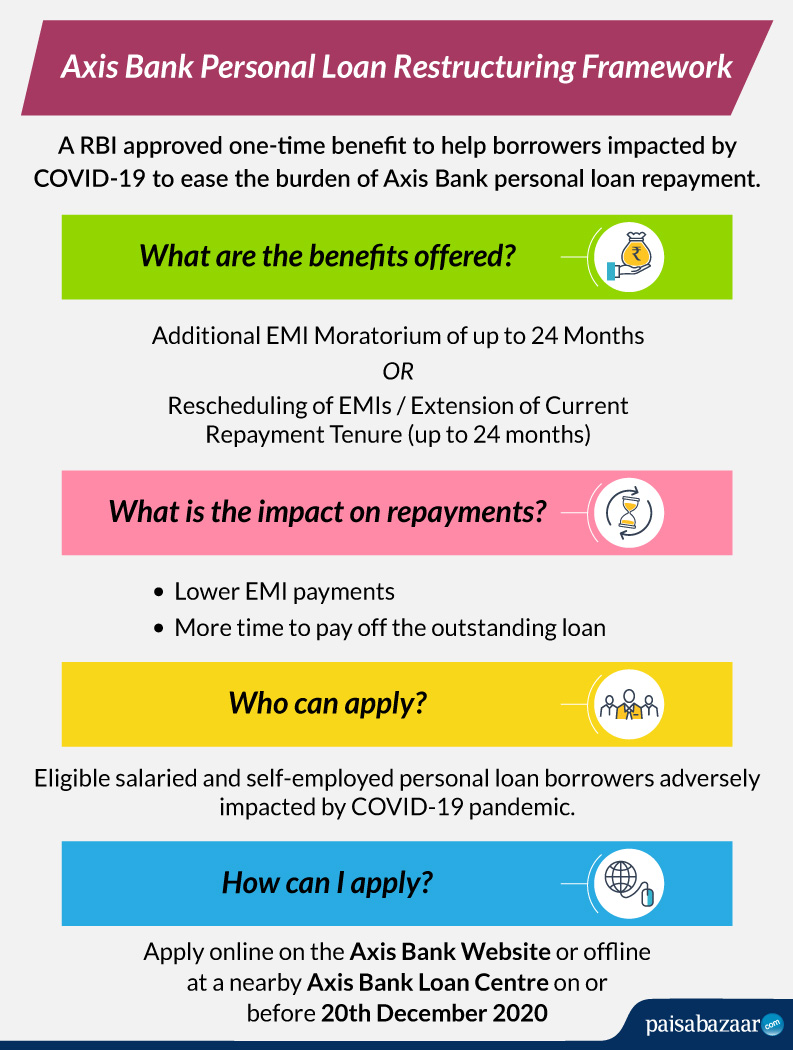

COVID-19 has shown us a glimpse of how everything can shatter even with proper planning. The Reserve Bank of India had implemented a moratorium on the EMIs, which primarily includes home loans. This was implemented back in March 2020 and saw a closure within six months. This was a massive step in assisting people affected by the pandemic. The Act permits setting up reconstruction companies that buy impaired assets (i.e. NPAs) of banks and financial institutions. By buying such impaired assets, reconstruction companies wipe out the balance sheets of banks and financial institutions.

You must be able to prove the hardship, for example, with copies of medical bills for an illness-related restructure. A homeowner generally applies for a mortgage loan restructure to obtain affordable monthly payments and keep the home. A mortgage restructure takes place when the borrower and lender work out new repayment terms on an existing mortgage. In 2010, the federal government put a loan restructure, or modification, program in place for troubled borrowers called the Home Affordable Modification Program . Some lenders have instituted other loan restructure programs outside HAMP.

FREED Financial Services LLC

Your home must be your primary residence to qualify for a loan restructure under HAMP. The principal balance of your loan must be under $729,750 for a one-unit home as of 2010, according to Making Home Affordable, the website of the government program. A mortgage balance on a two-family home cannot exceed $934,200, and a three-family home is capped at a balance of $1,129,250. A home with four units must not have a balance greater than $1,403,400, and homes with more than four units do not qualify. Your current monthly mortgage payment has to be more than 31 percent of your monthly income before taxes.

Both loan refinancing and loan restructuring offer better credit terms to the borrower. However, the circumstances under which they are opted for differ immensely. Planning the fulfilment of the debt obligations is the most important aspect of being a responsible borrower. However, there are always solutions to opt for to get out of unforeseeable situations. The option to repay the loan with equated monthly instalments makes it easier for people to borrow a large sum of money to meet their immediate financial obligations. However, because this is a one-of-a-kind case, it's difficult to say how much a borrower's credit score will be affected.

Everything About Balloon Payment and How it is Calculated

The loan restructuring request will get processed only if all the requisite documents are submitted and are verified as per our policy. To know more, please have a look at our FAQs in this page by scrolling below. Loan refinancing can be expensive and unless managed well, debt payments may spiral out of control. Therefore calculating all the expenses, interest payments, and factoring in difficult financial situations such as a job loss is important before opting for this. However, since this is a unique situation, it is difficult to estimate just how severely a borrower’s credit score gets affected.

The lender will require proof of the reason for the mortgage loan restructure. Lenders generally grant restructures only to homeowners in financial distress for legitimate reasons, as defined under HAMP. A loss of income due to the death or disability of a household family member, a serious medical illness suffered by yourself or a family member, and a temporary unemployment situation are common reasons for a restructure. You may be eligible for a restructure if you have an adjustable-rate mortgage that has reset. ARMs have variable interest rates, and when the interest rate resets, the monthly payment can rise unexpectedly.

Is Home Loan Restructuring a Smart Idea?

Identify the root causes of your property’s distress and why the property is facing challenges in complying with the requirements of your loan. What other problems at or affecting your property need to be addressed through a loan workout ? Your goal in this analysis is to develop a complete picture of what’s wrong so that in restructuring the loan, all looming issues can be addressed in a comprehensive manner, enabling the property to get back on track.

Creditors understand that if the individual or the company is pushed into bankruptcy or liquidation, they will receive considerably less. Loan restructuring can be a win-win situation for both parties because the company gets to avoid bankruptcy. The lenders earn more money than they would have received in a bankruptcy proceeding. Consequentially, most of the Indian population found it difficult to pay their loan EMIs.

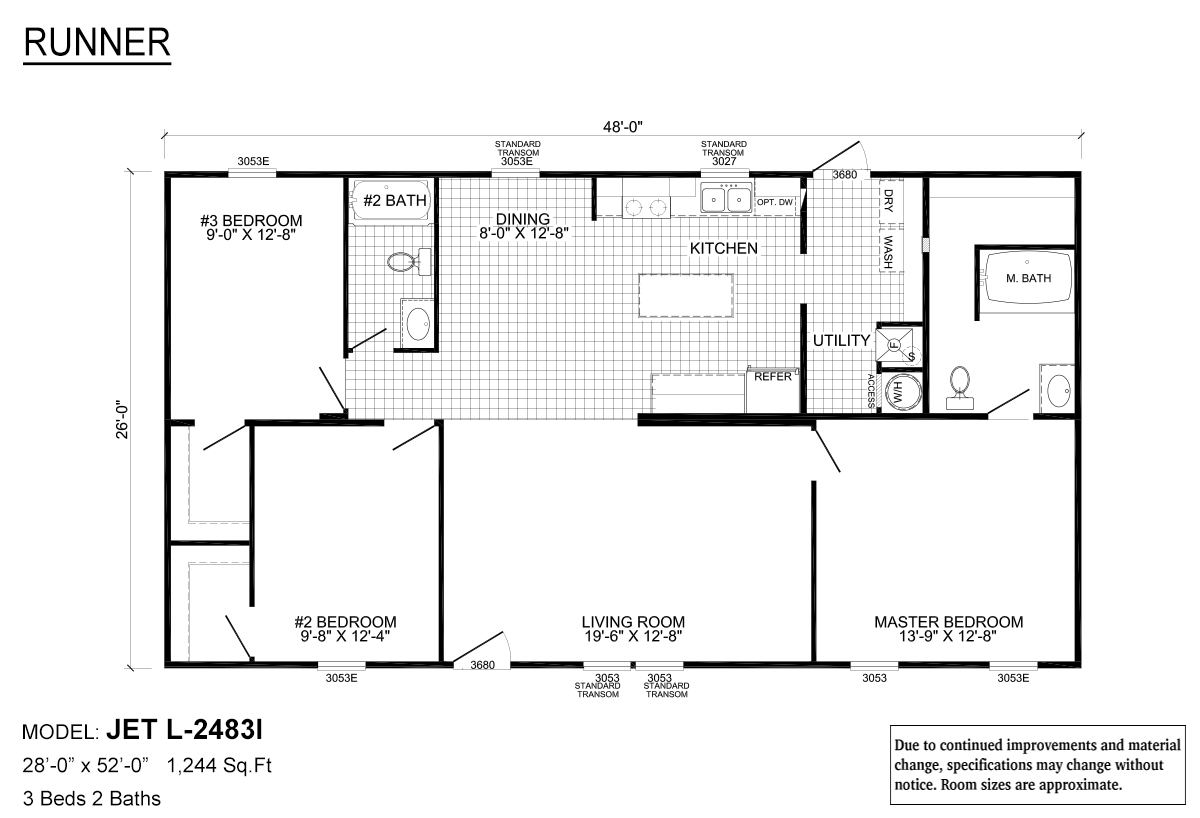

Tips to restructure mortgage loan

In certain cases, the time due for settlement payments can exceed a period of three months. When expats make Dubai their home, they want to purchase a property that suits their taste and comes within their financial means. If you want to know more about how to restructure mortgage loan, consider visiting our official website. A customer has a Rs 10 lakh loan for 20 years at an interest rate of 11.25% and the outstanding term now is 19 years. Assuming that the customer now want to reduce the term and interest liability, some choices are available. For an increase/acceleration in EMI, the customer has an option to increase the EMIs every year.

You’ve got options, like repayment help from your employer and coaching from a mortgage broker. These tips are appropriate if you’re current on your mortgage and have extra money. Struggling home owners should consider the government-sponsored Home Affordable Modification Program for mortgage restructuring.

Sometimes lenders will agree to a temporary restructuring to let you make lower payments for a limited time, like three or six months. You also may be able to get an agreement to block any foreclosure on the loan for some specified period to give you time to work out finances. If you’re having difficulties making your monthly repayments, our dedicated Debt Restructuring Specialists will work with you to develop a personalised debt repayment plan that suits your needs and budget. If the borrower owes more than he can repay to the lender, it can negatively affect his credit score. Any default on a loan repayment is reflected on the borrower’s credit report.

This is entirely on the capacity of the borrower on how swiftly they can pay back the loan. Opting for a home loan restructuring even when you have sufficient funds is not advisable. Let’s go through the details to understand its needs and importance.

If your account has been in default for more than the allowed number of days as per the RBI regulations pertaining to the one-time loan restructuring scheme, then you will not be eligible for loan restructuring. Therefore, if no other options are available, restructuring should be considered as the way forward. One-time loan restructuring may not affect credit scores, but that is not a given. If you see no other way out, you could use loan restructuring as a one-time option. However, avoid trying to restructure your loan to avoid any difficulty in availing loans in the future. Borrowers who are short of funds and wish to restructure their home loan, corporate or even opt for attractive refinancing options can do so seamlessly from Tata Capital.

Lenders allow you 60 days after issuing the notice to regularise the loan account and get it settled/written off. Download this white paper to see how recent migration trends are impacting everything from office occupancy rates to regional business opportunities to local consumer demographics. The contents of this article/infographic/picture/video are meant solely for information purposes. The contents are generic in nature and for informational purposes only.