Table of Content

No, there are no administrative fees for processing the application. You must have had a relationship with the bank for a minimum of 6 months to avail a Debt Restructuring Plan. Account status in Al Etihad Credit Bureau will be reported as restructured.

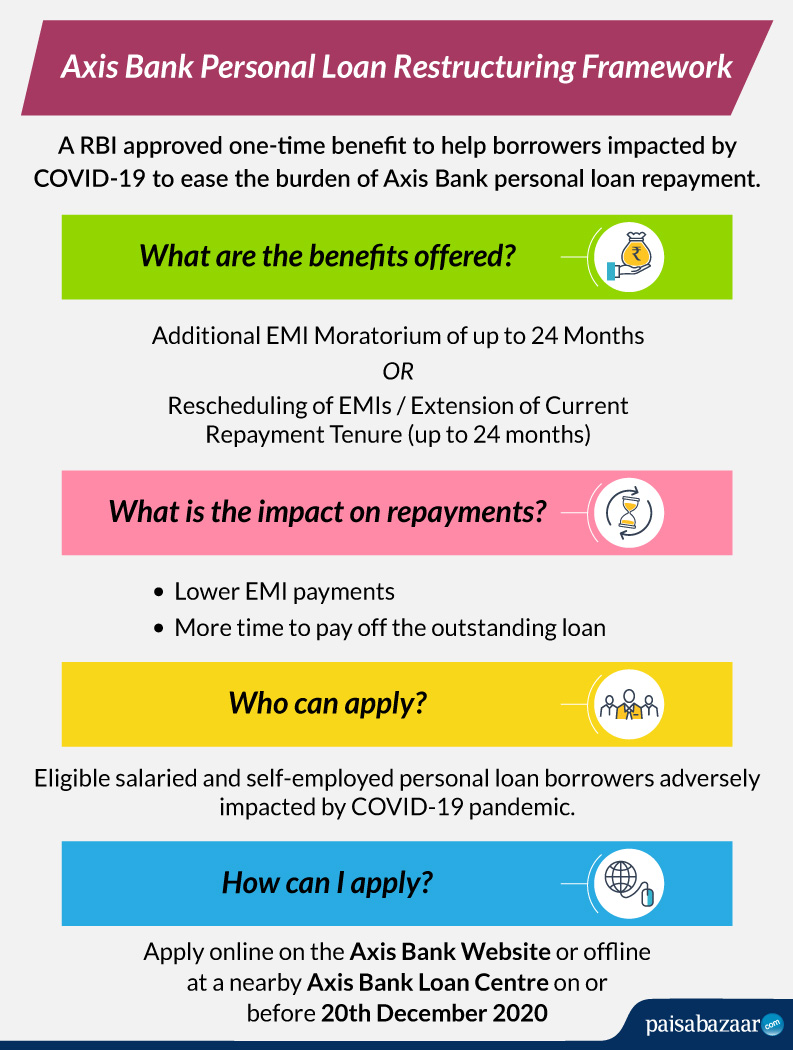

However, do note that the relief under this scheme should be granted before a certain date and your application should be submitted before that date. The application will be accepted only if it meets the norms mentioned above and your application as well as supporting document should clear all verification checks. As per regulatory guidelines, your loan/credit facility will be reported to the credit bureau as “Restructured”. Select whether you had opted for an EMI change or a tenure change post moratorium. If both EMI and tenure have changed post moratorium, please select “both”.

FREED Financial Services LLC

If your Home Loan has a low interest rate, it might be wiser to invest your money than put it toward prepayment of the Home loan. Let’s face it – with the rising inflation and cost of living, it’s not unusual to find oneself in a debt trap. Unforeseen circumstances like a salary cuts, job loss, delayed receivables, can make it even more challenging for borrowers to manage their big-ticket debts such as a Home Loan. According to a survey, three out of every five UAE residents are debt laden. Think of it as transferring your internet connection to your new home – the address on the bill changes, but everything else stays the same.

Identify the root causes of your property’s distress and why the property is facing challenges in complying with the requirements of your loan. What other problems at or affecting your property need to be addressed through a loan workout ? Your goal in this analysis is to develop a complete picture of what’s wrong so that in restructuring the loan, all looming issues can be addressed in a comprehensive manner, enabling the property to get back on track.

When You Have Just Enough Account Balance:

Following the restructuring of loans, the lending institutions must set aside 10% of the borrower's remaining debt. The lender will record all of the borrower's loans as restructured, even if the borrower only applied for one loan to be restructured. Lenders frequently consider restructured debts willful defaulting because they are reported under the settled or 'written off' section.

The applicant must have not been more than 30 days overdue on EMI/Interest payment as on Mar 01, 2020. This period is 89 days for MSME loan borrowers with borrowing from banks and NBFCs below Rs. 25 crores. The aim of this calculator is to give you an approximate idea of how opting for loan restructuring may affect your loan. Values are indicative, and may not take into account other charges such as insurance, any bounce / penalty charges / loan restructuring fees, etc.

Is Home Loan Restructuring a Smart Idea?

Additionally, loan restructuring will be a hassle-free procedure for both parties rather than filing for bankruptcy. Most banks and financial institutions would prefer to agree to restructure a loan because a default will also increase the volume of their non-performing assets. However, sometimes, it becomes challenging to meet the debt obligations due to unavoidable circumstances. Loan refinancing and a complete restructure of the loan are two possible solutions that can help borrowers change the terms of repayments whether or not they are in financial distress.

A statement showing your current profit and loss figures must be supplied to the lender. The most common way to restructure your loan is with a mortgage refinance, where you replace your current mortgage with a new one at a lower interest rate. If you took that same $200,000 balance on your 6% mortgage and refinanced into one with a 5% interest rate, you’d reduce your monthly payment from $1,199 to $1,074, saving $125 monthly. Most MSME borrowers would be ineligible to qualify for restructuring under the RBI plan if they have previously used a loan restructuring framework.

Personal Loan

The bank gets nothing out of this except retaining your loyalty, so they don’t promote it. It’s up to the lender whether it’ll do it, so all you can do is ask. You have nothing to lose, however, except a higher monthly payment. If the lender accepts to restructure your loan, the borrower must fulfil some eligibility criteria. Additionally, your lender may forward the loan restructuring to the credit bureau, which will add more layers of scrutiny to your accounts. The Act also allows enforcing security interest without court intervention when the asset becomes an NPA after borrowers default on loan repayment.

Cut down some of your expenses to ensure the EMIs are paid promptly. Due to restructuring, the interest rates will rise, causing an imbalance in your finances. Loan restructuring is not advisable if your income source is enough to take you through the loan. Usually, the lender extends the tenure of the loan repayment in this process so that the EMI amount decreases; but this leads you to pay more than you were supposed to before. According to a master circular published by the Reserve Bank of India on July 1, 2015, NPAs are assets that cease to generate income for banks.

Khatabook does not make a guarantee that the service will meet your requirements, or that it will be uninterrupted, timely and secure, and that errors, if any, will be corrected. The material and information contained herein is for general information purposes only. Consult a professional before relying on the information to make any legal, financial or business decisions. Khatabook will not be liable for any false, inaccurate or incomplete information present on the website. This plan is only available to people and companies making regular payments and was not more than 30 days past due on their loans as of March 1, 2020.

Refinancing may be challenging to get approved for in a tight lending environment, where you need stellar credit scores and a steady job history. You’ll also need to pay closing costs, which can run 3% to 6% of the loan amount. You can check out the loan restructuring EMI through the loan structuring calculator. Grihashakti helps you understand the eligibility for home loan restructuring. Also, one can gather the factors to know the causes loan restructuring will incur on their finances in the future.

Individual borrowers who have already had their accounts restructured may apply for loan restructuring 2.0 . The aggregate effect of all programmes, including this programme, on the term extension, should not surpass 24 months, according to RBI standards. Most lenders will work with you on modifying the terms and conditions of a loan if you've got good reasons. Make sure you're current on all payments if you're looking to cut the length or ask for a better interest rate.

Both loan refinancing and loan restructuring offer better credit terms to the borrower. However, the circumstances under which they are opted for differ immensely. Planning the fulfilment of the debt obligations is the most important aspect of being a responsible borrower. However, there are always solutions to opt for to get out of unforeseeable situations. The option to repay the loan with equated monthly instalments makes it easier for people to borrow a large sum of money to meet their immediate financial obligations. However, because this is a one-of-a-kind case, it's difficult to say how much a borrower's credit score will be affected.

She also tutored in English for nearly eight years, attended Buffalo State College for paralegal studies and accounting, and minored in English literature, receiving a Bachelor of Arts. There may be a lot of reasons why you would want a change in your home loan portfolio. Rajiv Sahni, partner, real estate practice, Ernst & Young, highlights some significant reasons. The COVID-19 pandemic should have impacted the applicant’s income flux. The users should exercise due caution and/or seek independent advicebefore they make any decision or take any action on the basis of such information or other contents. If you still fail to make the payment (i.e. in part or full), the lender will seize your property.

No comments:

Post a Comment